How to Show Traction to VCs When You're Still Pre-Revenue (Data-Driven Framework)

Here's the thing: most founders think they need revenue to show traction. That's just not true.

As a VC, we see hundreds of pre-revenue startups every year that successfully demonstrate compelling traction. The key is knowing which metrics actually matter and how to present them in a way that reduces investor risk.

Let's break down exactly how to show traction when you're still pre-revenue – with real frameworks you can use today.

What VCs Really Mean When They Say "Traction"

Traction isn't just about money coming in. It's proof that real people want what you're building and that your business can grow sustainably.

For pre-revenue startups, traction shows three critical things:

- Market demand exists for your solution

- Your product works and people actually use it

- You can acquire and keep users efficiently

Think of traction as evidence that reduces the biggest risks VCs worry about: "Will anyone actually pay for this?" and "Can this team execute?"

The User Engagement Foundation

Your most powerful traction metric as a pre-revenue startup? Active, engaged users.

Daily and Monthly Active Users (DAU/MAU)

Here's what we look for at different stages:

- Pre-seed: 5,000+ Daily Active Users with strong engagement

- Seed: 25,000-100,000 DAUs with clear network effects

- Series A: 600,000+ DAUs with proven retention

But raw numbers don't tell the whole story. Your DAU/MAU ratio matters more than total users. Aim for 50% or higher – this means half your monthly users are coming back daily, which is incredibly sticky.

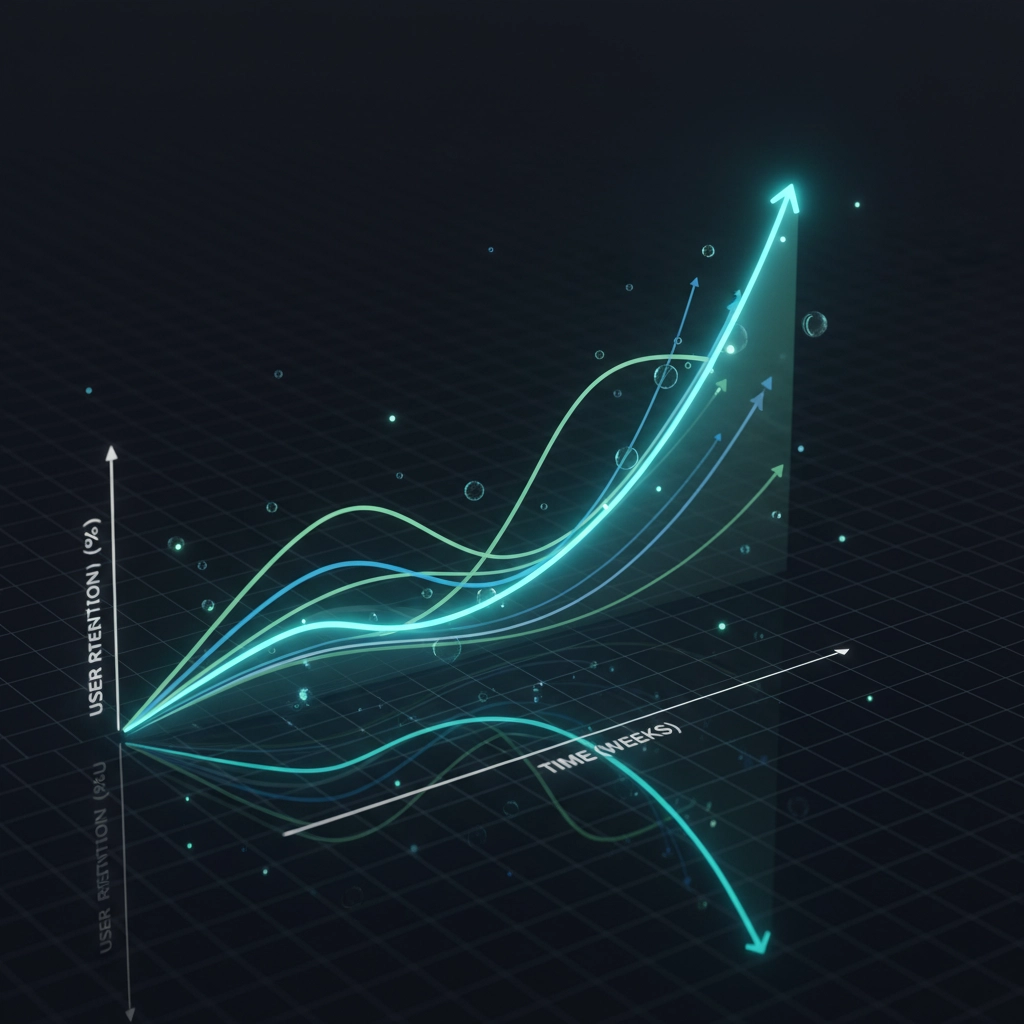

Retention Metrics That Actually Matter

The real test? Can you keep users coming back? Track these metrics:

- 6-month retention rate: Aim for 40%+ of users still active after six months

- Session frequency: How often do users return?

- Session duration: Are users spending meaningful time with your product?

We recently funded a pre-revenue startup with only 8,000 DAUs, but their 6-month retention was 65%. That told us everything we needed to know about product-market fit.

Market Validation: Proof People Want This

Numbers are great, but you need to prove actual demand exists in the real world.

Build Real Commitment

Waitlists aren't just marketing fluff – they're demand signals. But not all waitlists are created equal. We want to see:

- Substantial signup numbers (relative to your market)

- High-quality prospects (not just random emails)

- Engagement with waitlisted users (surveys, updates, feedback)

Letters of Intent (LOIs) are pure gold for B2B startups. Even if you can't close deals yet, signed LOIs show real businesses are willing to commit to paying for your solution.

Beta Testing Success

Your beta program should generate data, not just feedback. Track:

- Beta user retention: Are testers sticking around?

- Feature usage: Which parts of your product drive engagement?

- Conversion intent: How many beta users say they'd pay?

One portfolio company ran a 3-month beta with 200 users. 85% completed the program, and 72% said they'd purchase immediately at launch. That's traction.

Growth Efficiency Metrics

Even without revenue, you can prove your business model works.

Customer Acquisition Cost (CAC) and Lifetime Value (LTV)

Yes, you can calculate these pre-revenue:

- CAC: Track what you spend to acquire each engaged user

- LTV: Estimate based on beta user behavior, engagement depth, and stated purchase intent

Target an LTV:CAC ratio of 3:1 and CAC payback under 6 months. These numbers prove you can acquire users profitably.

Weekly Growth Rate

Consistent growth beats hockey stick promises every time. We look for 5-7% weekly growth in your core metrics – whether that's users, engagement, or pipeline.

Track this religiously. Even small, steady growth proves your acquisition engine works.

Strategic Validation Signals

Sometimes the strongest traction signals come from who believes in you.

Partnerships That Matter

Strategic partnerships aren't just nice-to-haves – they're risk reduction. When an established company partners with you, they're essentially validating your market position.

We funded a logistics startup partly because they'd signed partnerships with three major retailers for pilot programs. Those companies had done their own due diligence.

Quality Investors and Advisors

Who's already invested? Which advisors have joined your cap table? Respected names carry weight because they've done their own validation work.

But choose carefully – better to have fewer, high-quality investors than a long list of unknown angels.

The Intangibles That Seal the Deal

Data tells part of the story. These factors tell the rest.

Founder-Market Fit

We invest in teams, not just products. Show us:

- Relevant experience in your market or problem space

- Complementary skills across the founding team

- Previous execution – what have you built before?

- Domain expertise – do you deeply understand this problem?

Market Timing and Opportunity

Your Total Addressable Market (TAM) needs to be large and growing. But more importantly, why now? What's changed that makes this the right time for your solution?

The best founders can articulate exactly why their timing is perfect – new regulations, technology shifts, changing consumer behavior, etc.

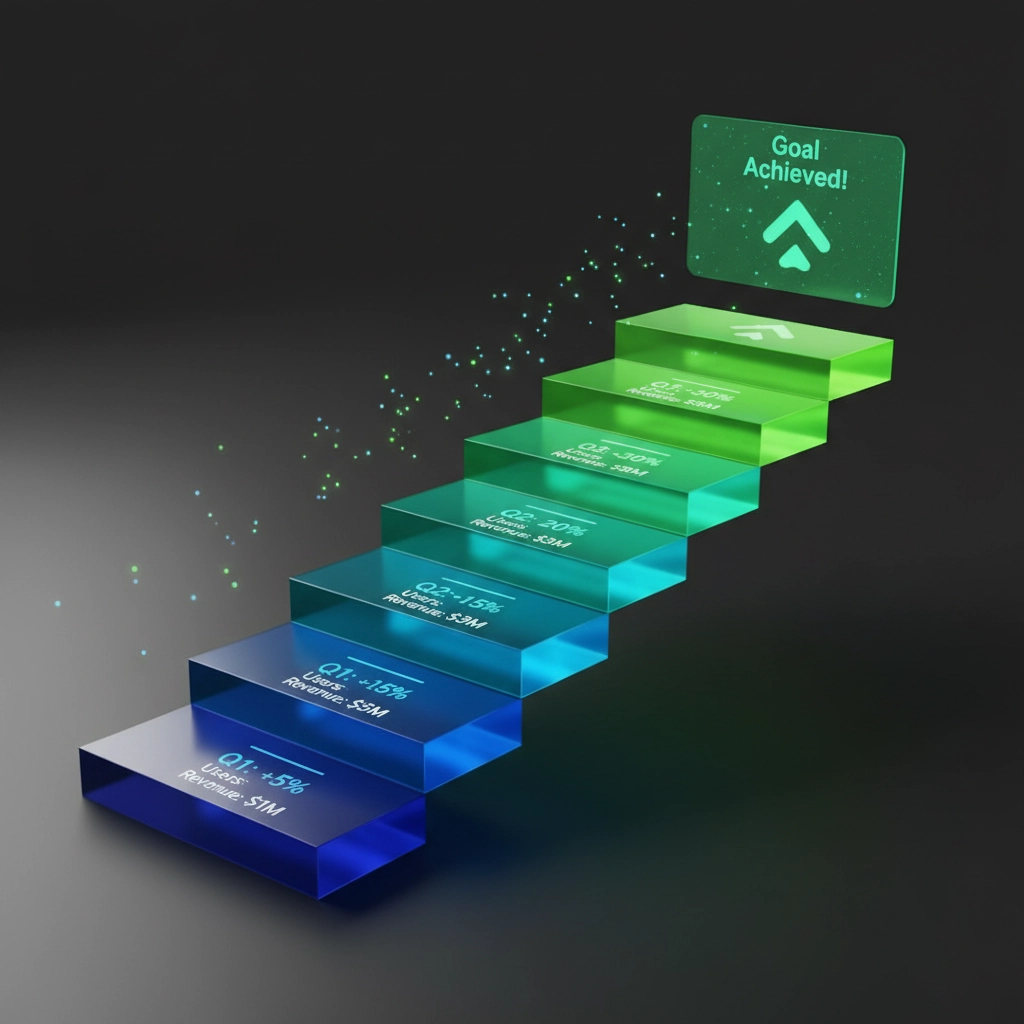

Stage-Specific Metrics Framework

Different funding stages require different emphasis:

Pre-Seed Focus

- Pilot customer success

- Product development milestones

- Early user engagement

- Team building

Seed Stage Requirements

- User acquisition and retention

- Market validation signals

- Growth rate consistency

- Partnership development

Series A Preparation

- Path to revenue clarity

- Scalable business model

- Market expansion strategy

- Operational efficiency

Avoid These Vanity Metrics

Not all metrics impress VCs. Avoid leading with:

- Raw signup numbers without engagement context

- Social media followers unless directly tied to business outcomes

- Website traffic without conversion data

- Press mentions without business impact

Focus on metrics that prove business viability, not just attention.

Your Traction Presentation Framework

When pitching VCs, structure your traction story around three pillars:

1. Product-Market Fit Evidence

- DAU/MAU and retention data

- User engagement metrics

- Net Promoter Score

- Qualitative feedback highlights

2. Market Validation Proof

- LOIs and pre-registrations

- Beta program results

- Strategic partnerships

- Customer interview insights

3. Growth Model Validation

- CAC and LTV projections

- Weekly growth rates

- Conversion funnel metrics

- Churn analysis

The Bottom Line

Pre-revenue doesn't mean pre-traction. The startups that get funded are the ones that prove real people want their solution and that they can deliver it efficiently.

Focus on engagement over vanity metrics. Build real relationships with users, not just email lists. Show consistent growth, even if it's small. And always remember – we're not just investing in your current metrics, we're investing in your ability to improve them.

At Ventureship, we've seen pre-revenue companies raise millions by nailing these fundamentals. The data doesn't lie, and neither should your pitch.

Got questions about showing traction for your specific situation? The framework above works, but every startup is different. Focus on the metrics that best prove demand for your unique solution.