Data-Driven Decisions: Turning Startup Traction Into Funding

Let's be honest: raising funding in 2025 isn't about having the flashiest pitch deck or the most charismatic founder anymore. It's about proving your startup works with cold, hard data. Gone are the days when investors made gut decisions based on "potential." Today's VCs want to see traction, and they want the numbers to back it up.

The shift toward data-driven funding decisions has fundamentally changed how startups need to approach fundraising. At Ventureship, we've seen firsthand how founders who master this approach consistently outperform their peers in securing capital. The startups that get funded are the ones that can tell a compelling story through their metrics.

Why Data-Driven Traction Matters More Than Ever

The venture capital world has evolved dramatically. Modern VC firms are using algorithms, AI, and sophisticated data platforms to evaluate deals. This isn't just about being more thorough: it's about survival. With increased competition and market uncertainty, investors can't afford to make emotional decisions anymore.

What does this mean for you as a founder? Simple: your business metrics have become your most powerful fundraising tool. When you make data-driven decisions throughout your startup journey, you're not just building a better business: you're creating a compelling case for investment that speaks directly to how modern investors evaluate opportunities.

Research shows that data-driven companies see an 8% increase in revenues and profits, plus a 4% reduction in costs. These aren't just nice-to-have improvements: they're the exact metrics that catch investor attention and demonstrate the kind of operational excellence that leads to successful exits.

The Traction Metrics That Actually Move the Needle

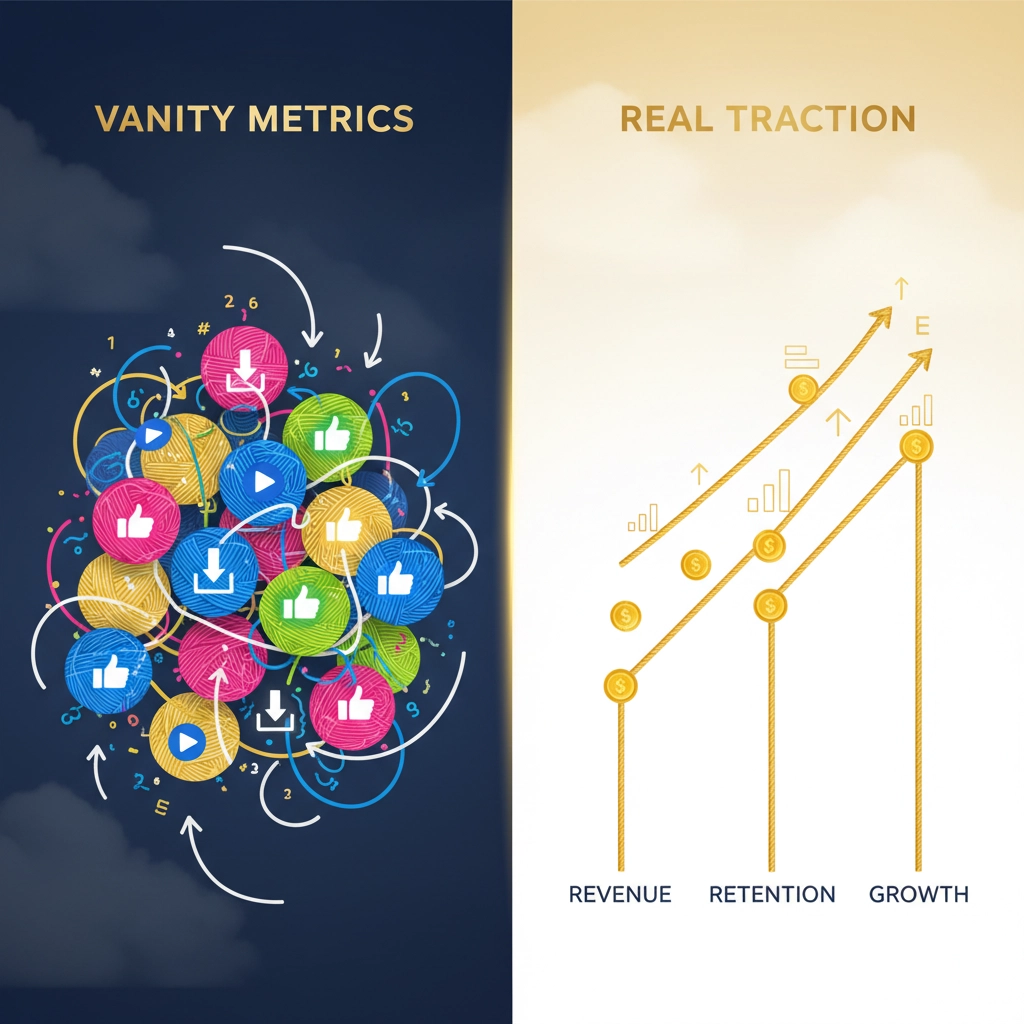

Not all metrics are created equal, and understanding which ones matter most can make or break your fundraising efforts. The key is focusing on metrics that demonstrate both product-market fit and scalable growth potential.

Monthly Recurring Revenue (MRR) remains the gold standard for SaaS startups. It's the clearest indicator of sustainable business momentum and shows investors that customers are willing to pay for your solution consistently. But MRR alone isn't enough: you need to show it's growing month-over-month at a healthy clip.

Customer retention and churn rates have become increasingly critical. Investors in 2025 are prioritizing startups that can keep their customers happy and engaged over those that simply acquire users quickly. A startup with 1,500 paying customers, 12% month-over-month revenue growth, and less than 3% customer churn rate is exactly what investors want to see.

Customer Acquisition Cost (CAC) versus Lifetime Value (LTV) shows whether you're building a sustainable business model. The magic happens when your LTV is at least 3x your CAC, demonstrating that you can acquire customers profitably and scale efficiently.

The specific metrics you should focus on depend on your stage. Pre-revenue startups need to show pilot customers and committed design partners. Seed-stage companies should emphasize user acquisition and engagement. Series A and beyond requires clear revenue growth and profitability pathways.

Building Real Traction Through Smart Decisions

Here's where the rubber meets the road: using data to actually build the traction that attracts funding. This isn't about manipulating numbers: it's about making informed decisions that drive real business results.

Start by identifying your North Star metric: the one number that best captures the core value your product delivers to customers. For most startups, this connects directly to revenue or user engagement. Once you've identified this metric, align every business decision around moving that number in the right direction.

The most successful founders we work with at Ventureship treat their business like a series of experiments. They form hypotheses, test them with real data, and quickly pivot when the numbers don't support their assumptions. This approach doesn't just build better products: it creates the kind of rapid iteration and improvement that investors love to see.

Focus on metrics that demonstrate momentum rather than just size. Investors would rather see consistent 10% month-over-month growth over six months than one big spike followed by stagnation. Consistent growth suggests you've found something sustainable and scalable.

What Investors Really Want in 2025

The investment landscape has shifted significantly, and understanding these changes is crucial for founders looking to raise capital. The days of "growth at all costs" are over. Today's investors prioritize capital efficiency, sustainable unit economics, and clear paths to profitability.

Retention over acquisition has become the dominant theme. Startups that can demonstrate strong customer retention and low churn rates are raising 25% more in funding rounds compared to their peers. This shift reflects a broader recognition that sustainable businesses are built on satisfied customers, not just rapid user growth.

Profitability pathways are no longer nice-to-have: they're essential. Even early-stage startups need to show investors how they'll eventually generate sustainable profits. This doesn't mean you need to be profitable today, but you do need a clear, data-backed plan for getting there.

Capital efficiency has become a competitive advantage. Investors are looking for startups that can achieve significant milestones without burning massive amounts of cash. Show them how you're maximizing every dollar of investment through smart, data-driven resource allocation.

Telling Your Data Story Effectively

Having great metrics is only half the battle: you need to communicate them effectively to investors. This is where many founders struggle, either by overwhelming investors with too much data or by presenting numbers without context.

Your data story should follow a clear narrative arc. Start with the problem you're solving, show how your solution addresses it (using customer data), demonstrate traction through key metrics, and project future growth based on historical trends. Each data point should build on the previous one to create a compelling case for investment.

Accuracy is non-negotiable. Inaccurate data will destroy your credibility faster than having smaller numbers to present. Source your data from reliable platforms, verify everything, and be prepared to dive deep into the methodology behind your metrics during investor meetings.

Context matters as much as the numbers themselves. Don't just show that your MRR grew 15% last month: explain what specific initiatives drove that growth and how you plan to sustain or accelerate it going forward. Investors want to see that you understand the levers that drive your business, not just that you can track the results.

How Ventureship Helps Founders Succeed

At Ventureship, we've built our entire approach around helping founders develop the data-driven mindset that attracts investment. We don't just provide capital: we help startups build the systems and processes that generate the kind of traction that scales.

Our portfolio companies get access to frameworks for tracking the metrics that matter most at their stage. We help them set up proper analytics infrastructure, identify their North Star metrics, and build reporting systems that provide real-time insights into business performance.

But data alone isn't enough. We also provide the mentorship and strategic guidance that helps founders interpret their data and make smart decisions based on what they're seeing. This combination of analytical rigor and strategic thinking is what separates successful startups from those that struggle to gain traction.

The founders who succeed in today's funding environment are those who embrace data-driven decision-making from day one. They use metrics not just to track their progress, but to guide their strategy, optimize their operations, and tell compelling stories to investors.

The shift toward data-driven fundraising isn't just a trend: it's the new reality of venture capital. The startups that adapt to this reality and learn to leverage their data effectively will be the ones that secure funding and build successful, scalable businesses. The question isn't whether you have good metrics: it's whether you're using them to make the decisions that will drive your startup's success.