5 Secrets From Underserved Founders Who Raised Millions Outside Major Startup Hubs

Silicon Valley and New York get all the headlines, but some of the most impressive funding stories are happening in places like Denver, Atlanta, and Salt Lake City. Founders in these "underserved" markets face real challenges: limited networks, fewer local investors, and less media attention. But here's what the data doesn't tell you: these same founders are developing strategies that coastal startups wish they had.

After analyzing dozens of successful fundraises from founders outside major hubs, we've identified five game-changing secrets that consistently separate the funded from the unfunded. These aren't just feel-good stories: they're tactical approaches that have helped founders raise millions despite geographic disadvantages.

Secret #1: Turn Cold Outreach Into Your Superpower

When you can't rely on warm introductions from Stanford roommates or Y Combinator alumni, you get really good at cold outreach. And that's actually a massive advantage.

The best underserved founders treat fundraising like a structured sales campaign rather than hoping for lucky networking breaks. They use platforms like Foundersuite, Crunchbase, and NfX Signal to systematically identify investors who are actively writing checks in their space.

But here's where most founders mess up: they send generic pitches. Successful founders craft highly personalized outreach that demonstrates deep research into the investor's portfolio and thesis. They reference specific portfolio companies, recent blog posts, or market observations that align with their startup.

The tactical approach involves creating multiple versions of your materials:

- A concise teaser deck for initial outreach (no more than 8 slides)

- An in-depth presentation for actual meetings (12-15 slides)

- Follow-up materials that address specific investor concerns raised during meetings

Focus on clarity and storytelling over flashy design. Your goal is capturing attention and securing that crucial first meeting, not winning design awards.

The founders who master this approach often outperform their well-connected counterparts because they've developed systematic processes that scale. While coastal founders rely on their networks, underserved founders build repeatable systems.

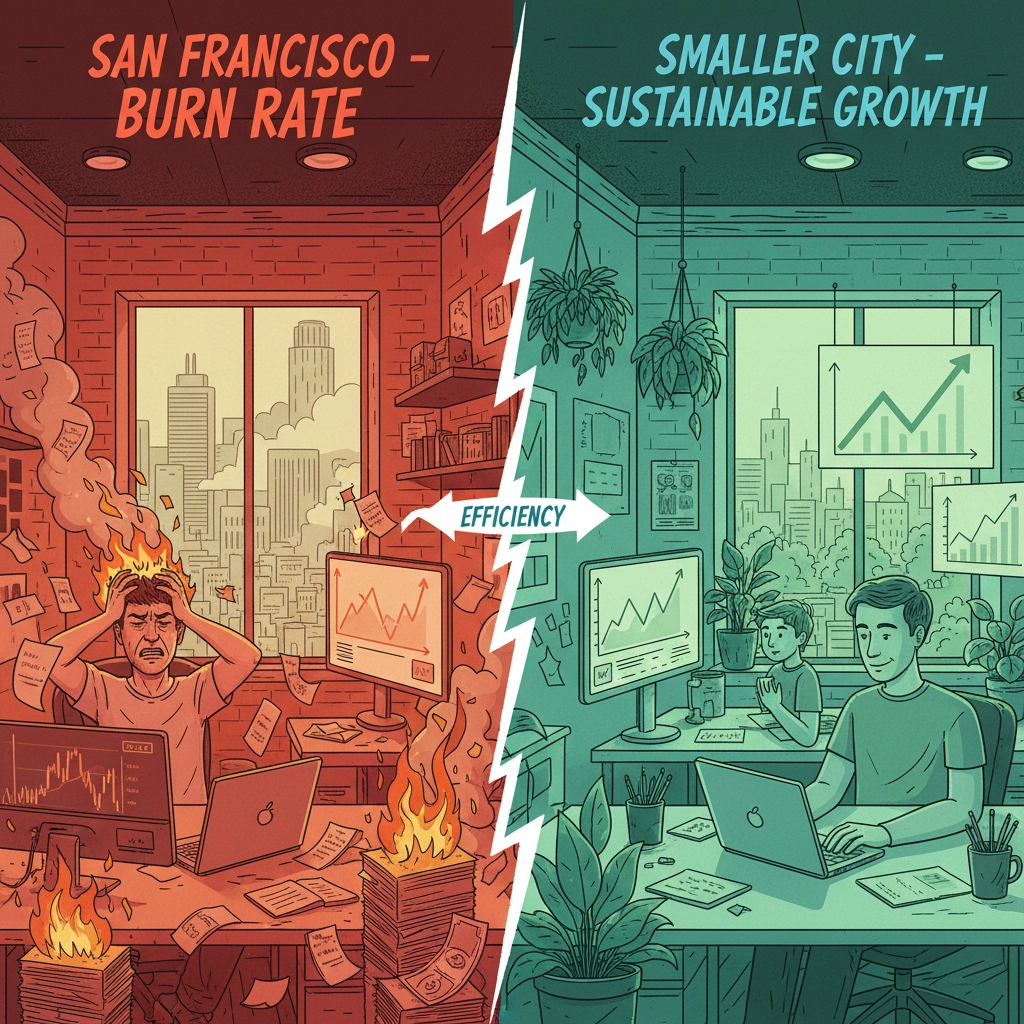

Secret #2: Flip Your Geographic "Disadvantage" Into a Capital Efficiency Story

Smart founders have learned to reframe their location as a competitive advantage rather than a limitation. Companies in emerging ecosystems are often significantly more capital efficient than their coastal counterparts.

This efficiency translates into metrics that sophisticated investors increasingly value: longer runway, higher margins, better unit economics, and lower customer acquisition costs. A startup in Austin that raised $2M can often achieve the same milestones as a San Francisco company that raised $5M.

Here's the opportunity that most founders miss: there's a specific funding gap at the Series A level ($5-10M range) for companies outside major hubs. Mega-funds focus on billion-dollar checks at later stages, while local investors often can't write large enough checks for Series A rounds.

This creates a sweet spot for founders who can articulate their capital efficiency story effectively. You're not competing against every startup in Silicon Valley: you're targeting investors who specifically look for these overlooked opportunities.

The key metrics to highlight:

- Revenue per employee compared to coastal competitors

- Customer acquisition cost in your market vs. major hubs

- Engineering talent costs and retention rates

- Office lease costs as percentage of revenue

Frame these advantages in terms of investor returns, not just operational efficiency. Show how your geographic advantages translate into better unit economics and faster paths to profitability.

Secret #3: Build Strategic Non-Monetary Partnerships Before You Need Them

Underrepresented founders often lack supporters willing to put their social capital on the line to connect them with investors and customers. The solution isn't to wait for these connections: it's to systematically build relationships with organizations that offer more than just funding.

The most successful founders cultivate partnerships with accelerators, industry associations, corporate innovation labs, and platform companies that can provide unique knowledge, connections, and resources specific to their industry.

These partnerships serve multiple purposes:

- Credibility and validation that investors value

- Access to industry expertise and customer insights

- Introductions to relevant investors and strategic partners

- Co-marketing opportunities that extend your reach

For example, a fintech startup in Nashville built relationships with regional banks and credit unions before raising their Series A. When investors called these partners for references, they heard consistent themes about the founders' deep industry understanding and customer focus. This third-party validation was more powerful than any pitch deck slide.

Companies are also increasingly integrating startups into their platform-based revenue models, creating win-win scenarios where you get customers and credibility while they get innovation. Look for these opportunities in your market: they're often easier to access outside major hubs where competition for corporate attention is less intense.

Secret #4: Master the Art of Consistent Investor Communication

Successful fundraising isn't just about securing initial meetings: it's about maintaining momentum throughout the entire process. Underserved founders must be more intentional about staying visible and building long-term investor relationships.

This means following up on every meeting within 24 hours, reiterating key points and outlining clear next steps. But more importantly, it means sending regular updates highlighting milestones, wins, and specific requests for support: even to investors who haven't committed yet.

Most founders only communicate with investors when they need something. Smart founders maintain visibility through:

- Monthly investor updates (even during non-fundraising periods)

- LinkedIn content that demonstrates thought leadership

- Speaking opportunities at industry events

- Media appearances that build credibility

This consistent communication pattern demonstrates the discipline and follow-through that investors want to see in founders. It also keeps your startup top of mind when investors are considering new opportunities or making referrals.

The tactical framework:

- Send updates on the same day each month

- Include three key metrics, one major win, and one specific ask

- Reference previous conversations to show you value their input

- Share relevant industry insights that demonstrate your market knowledge

Remember, fundraising is relationship building, not transaction completion. The investors who pass on your current round might lead your next round if you maintain strong communication.

Secret #5: Prove That Founder Quality Trumps Geographic Proximity

The most successful underserved founders understand that investors ultimately back founder quality over location. The key is demonstrating exceptional resilience, vision, and execution capability rather than trying to compensate for geographic disadvantages.

Investors are increasingly willing to travel and engage with ecosystems beyond traditional hubs when they identify founders who are "willing to go the distance." This means building a reputation for being highly engaged and transparent with your board and advisors, regardless of physical distance.

Show that you can work effectively with remote investors through:

- Structured board communications and reporting

- Proactive problem-solving and transparent issue resolution

- Clear milestone tracking and accountability

- Strategic thinking that extends beyond day-to-day operations

The insight that changes everything: capital concentration creates systematic gaps that savvy founders can exploit. When investors see founders who combine coastal-level ambition with interior-market capital efficiency, they recognize the potential for outsized returns.

Your geographic location isn't a bug: it's a feature. The founders who successfully raise millions outside major hubs don't apologize for their location. They leverage it as a competitive advantage that creates better unit economics, stronger team loyalty, and more focused execution.

The venture capital industry is evolving. Geographic constraints that seemed insurmountable five years ago are becoming strategic advantages for founders who know how to position them correctly. These five secrets aren't just survival strategies: they're blueprints for building stronger, more sustainable startups that deliver exceptional returns to investors.

The next time someone suggests you need to move to Silicon Valley to raise serious capital, show them the growing list of successful companies that stayed home and raised millions anyway. Sometimes the best opportunity is the one everyone else overlooks.