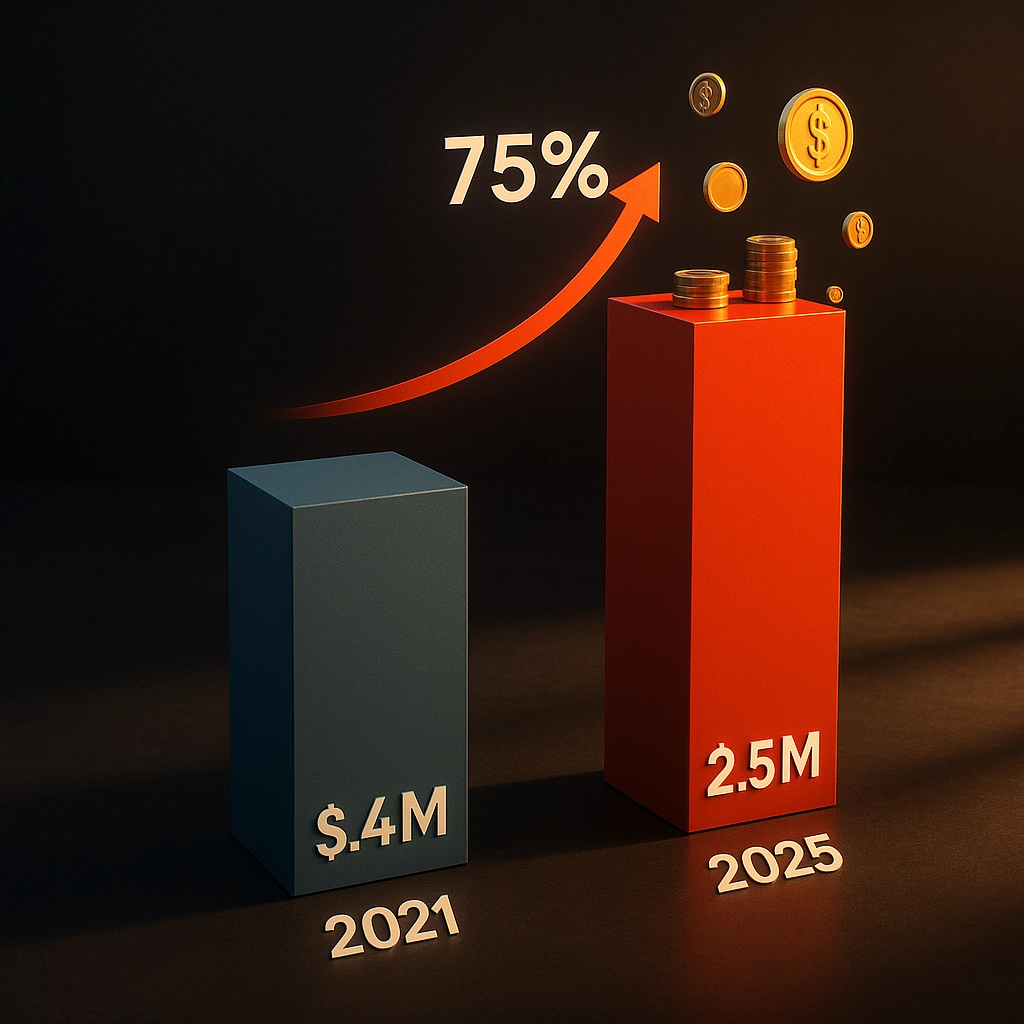

Series A Funding in 2025: Why You Need $2.5M Revenue (75% Higher Than 2021)

The fundraising landscape has completely shifted. If you're planning to raise a Series A in 2025, you better buckle up – because what worked in 2021 won't cut it anymore.

The numbers don't lie: median revenue requirements for Series A funding have jumped from $1.4 million to $2.5 million in annual recurring revenue. That's a whopping 75% increase in just four years. For founders who've been building toward that magic $1M milestone, this news hits like a cold shower.

But here's the thing – this isn't just about higher numbers. It's about a fundamental shift in how investors view risk, growth, and what it actually takes to build a sustainable business in today's market.

The New Revenue Reality

Back in 2021, hitting $1.4 million in ARR was your golden ticket to Series A conversations. Investors were writing checks based on potential, hockey stick projections, and a lot of faith in founder vision. Those days are over.

Today's median Series A company needs to demonstrate $2.5 million in ARR before investors will even take the meeting seriously. This isn't some arbitrary increase – it reflects a market that's learned hard lessons about sustainable growth versus growth at any cost.

The shift isn't uniform across all funding stages either. While Series A requirements jumped dramatically, Series B thresholds only increased modestly from $5 million to $6 million (about 20%). Series C has remained relatively stable around $14 million. This suggests investors are using Series A as their primary filter for separating real businesses from nice-to-have products.

For marketplace founders, the bar is even higher. The revenue hurdle has shifted from $1 million in net revenue to $2-3 million, factoring in typical take rates that mean you need significantly more gross merchandise value to hit these numbers.

Why Investors Raised the Bar

The 75% increase didn't happen in a vacuum. It's the result of several converging market forces that have fundamentally changed how investors evaluate early-stage companies.

First, risk consciousness has replaced the "spray and pray" mentality of the 2021 funding frenzy. Investors watched too many companies burn through Series A capital without finding sustainable unit economics or clear paths to profitability. They want proof of concept, not just proof of possibility.

Second, the market reset taught everyone that revenue quality matters more than revenue quantity. A company with $2.5 million in sticky, recurring revenue from happy customers is infinitely more valuable than one with $2.5 million in one-time sales from price-sensitive buyers.

Third, operational discipline has become non-negotiable. Investors want to see founders who understand their numbers, can forecast accurately, and have built systems that scale. The days of "we'll figure it out with more money" are long gone.

The Complete Metrics Playbook

Revenue is just the entry fee. Today's Series A investors are evaluating companies against a comprehensive scorecard that includes:

Core Financial Metrics:

- Annual Recurring Revenue: $2.5M minimum

- Year-over-year growth: 70% or higher

- Gross margins: 40% minimum

- Monthly recurring revenue growth: Consistent month-over-month increases

Efficiency Indicators:

- Burn multiple: Less than 1.0x

- CAC payback period: Under 9 months

- LTV/CAC ratio: 3:1 or better

- Rule of 40: Growth rate plus profit margin exceeding 40%

Customer Health:

- Net revenue retention: 110% or higher

- Gross churn rate: Less than 5%

- Customer satisfaction scores: Strong NPS or equivalent metrics

These aren't nice-to-haves – they're requirements. Investors use these metrics to quickly filter opportunities and focus their time on companies that demonstrate both growth and efficiency.

What This Means for Your Timeline

The higher revenue bar has real implications for startup planning and fundraising strategy. Most importantly, it extends the timeline between seed and Series A funding.

Where companies previously might have raised Series A 12-18 months after seed, founders now need to plan for 24-36 months. This means seed rounds need to last longer, often requiring bridge rounds or seed extensions to reach the necessary traction levels.

The average Series A round size has increased to $16.6 million in 2025, reflecting both the higher requirements and investors' willingness to deploy more capital into companies that clear the bar. But getting to that bar takes more time and money than it used to.

For marketplace businesses, this timeline extension is even more pronounced. Building to $2-3 million in net revenue (which might require $20-30 million in GMV for a typical marketplace) takes substantial time and user acquisition investment.

Strategic Preparation for the New Normal

Success in this environment requires different preparation than the old "raise early and often" playbook. Here's what actually works:

Extend Your Runway Strategically

Plan for a longer journey to Series A. This might mean raising a larger seed round, cutting burn rate earlier, or finding creative revenue streams to extend runway without additional dilution.

Build Metrics Infrastructure Early

Start tracking key metrics from day one. Investors expect clean, consistent data going back 12+ months. You can't retrofit good metrics – they need to be built into your operations from the beginning.

Focus on Revenue Quality

Not all revenue is created equal. Prioritize recurring revenue, high-retention customers, and sustainable unit economics over vanity metrics that don't translate to long-term value.

Develop Market Validation Proof

Beyond numbers, investors want to see evidence that you're solving a real problem for a significant market. Customer testimonials, retention data, and expansion revenue tell this story better than projections.

The Opportunity in Higher Standards

While the increased requirements create challenges, they also represent opportunity for well-prepared founders. The higher bar means less competition for Series A capital among companies that actually reach it.

Investors are writing larger checks to fewer companies, meaning those who clear the threshold often see more favorable terms and stronger investor commitment. The market has become more efficient at identifying truly scalable businesses.

Companies that reach the new Series A benchmarks also tend to be better positioned for subsequent funding rounds. They've already demonstrated the operational discipline and market traction that later-stage investors require.

Building for the Long Term

The 75% increase in revenue requirements isn't a temporary market correction – it's the new normal. The startup ecosystem has matured, and with it, investor expectations for what constitutes a fundable business.

This shift rewards founders who focus on sustainable growth, strong unit economics, and real market validation over hype and projections. While it makes the path to Series A longer and more challenging, it also creates a more sustainable foundation for long-term success.

The companies that thrive in this environment will be those that embrace the higher standards as an opportunity to build stronger, more defensible businesses. The revenue requirement increase might seem daunting, but it's ultimately creating a healthier startup ecosystem where success is built on fundamentals rather than just fundraising ability.

For founders building toward Series A, the message is clear: plan for a longer journey, focus on metrics that matter, and build a business that can thrive in any market condition. The $2.5 million revenue requirement isn't just a funding benchmark – it's a sign that you've built something worth scaling.